Problem

In 2022, a quarterly review of our loan products surfaced a trend of slowing growth and decreasing satisfaction among new members acquired through credit cards. The leadership of the line of business expressed confidence that improving the member experience would reverse the trends. However, there was uncertainty regarding:

- The implications of experience improvements on card engagement

- The impact of improvements on prioritized card-related efforts owned by other business units and functions

- The most critical problem areas for improvement

Approach

I partnered with the product manager from the line of business to organize a dynamic project team aimed at addressing uncertainties and discovering key opportunities to impact new acquisitions, card engagement, and member satisfaction. I employed a human-centered approach and led the team across three phases to define the target audience, visualize a collective understanding, and prioritize critical problem areas.

In the first phase, we gathered up all the knowledge distributed across the business unit and supporting functions. This initial effort enabled a holistic understanding of the problem space from both business and member perspectives. The information also helped to define distinct segments, laying the groundwork for discussions to determine the target audience for each credit card.

We utilized personas to humanize the data as well as foster empathy for the member segments, establishing a common language for productive cross-functional conversations. This approach also facilitated quicker alignment on the target audience.

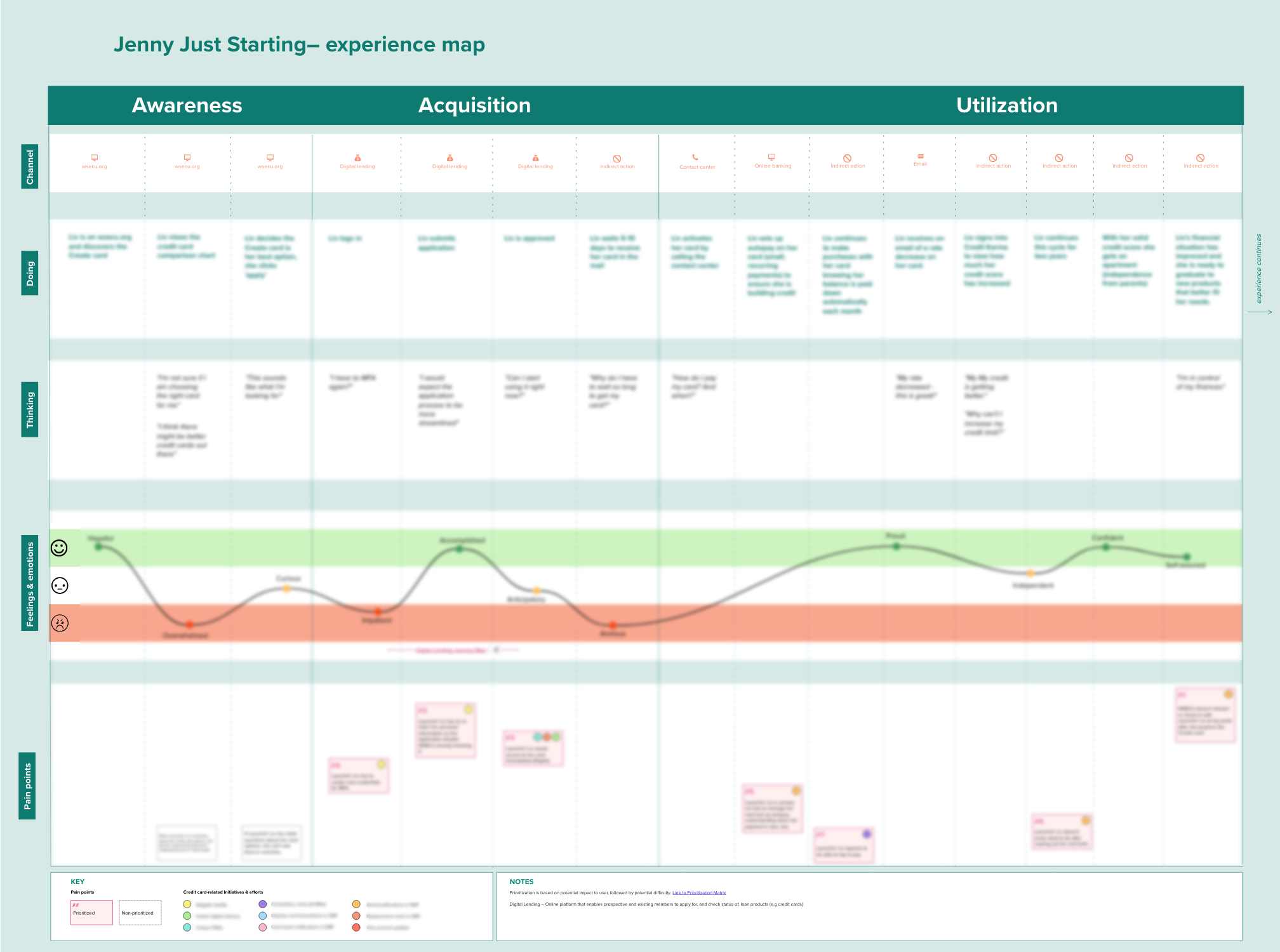

During the second phase, we facilitated experience mapping workshops with a diverse group of business stakeholders. The activities created alignment on key member behaviors and needs across the experience and resulted in richly descriptive pain points.

The workshops amplified our collective understanding and deepened our empathy for each target audience. The experience maps created from these inputs visualized our insights into the target audiences for our credit cards. Like the personas, these maps served as tools for considered decision-making and facilitated new discussions in a common language between teams that didn’t usually work together.

In the final phase, we focused on prioritization and identifying the most critical problems to address. Along the way, a pivotal insight emerged.

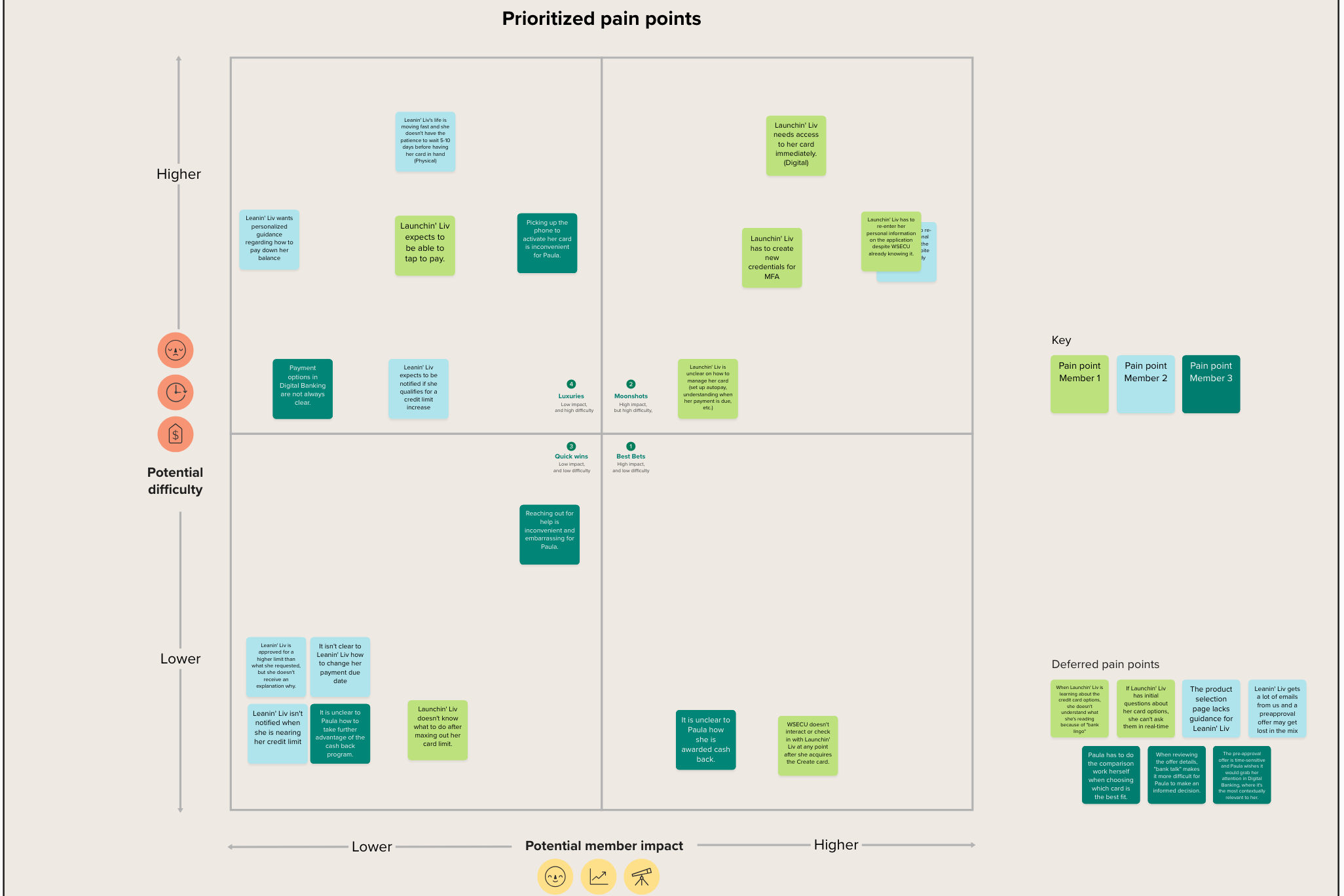

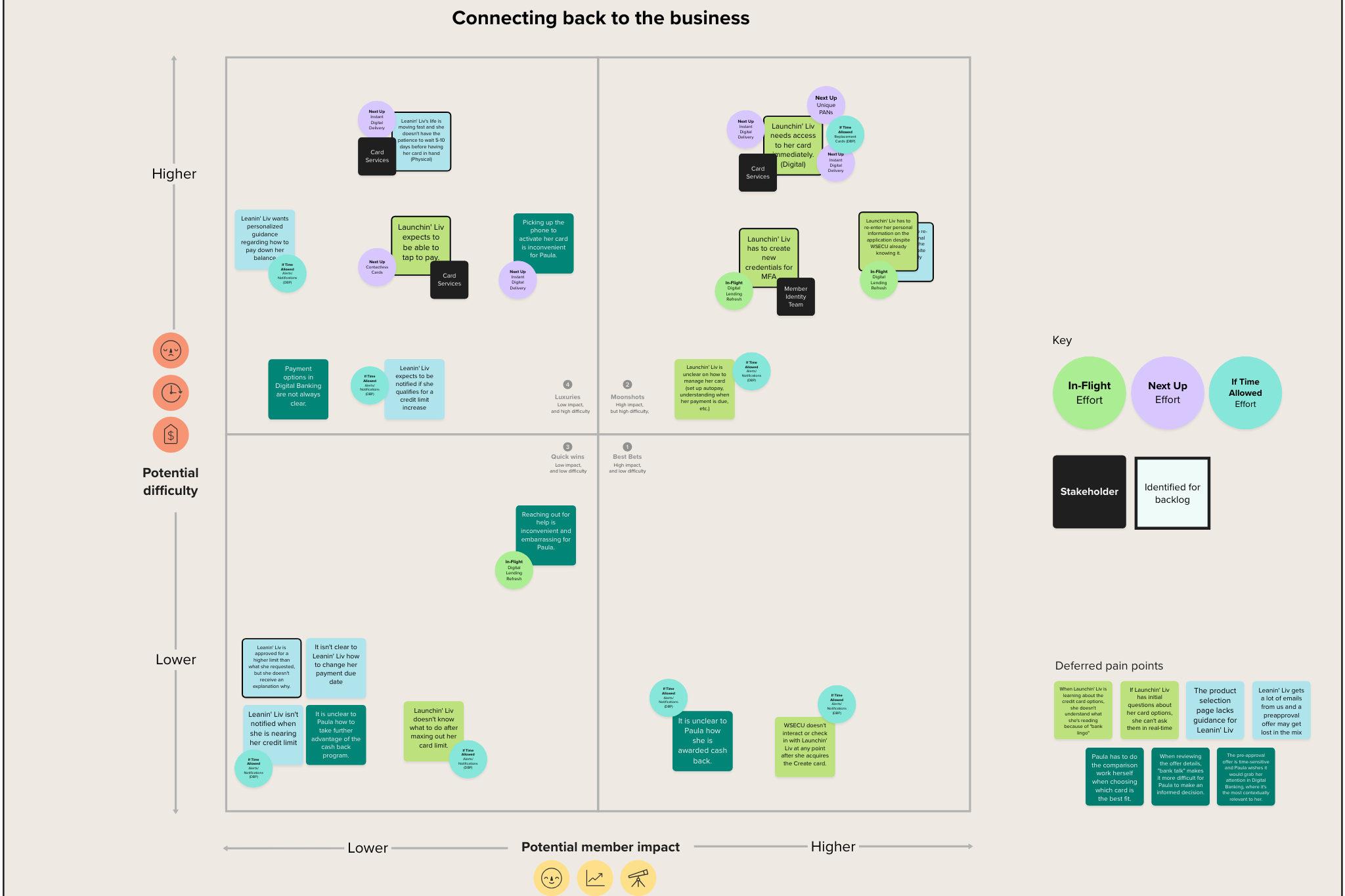

In the first of three data analysis sessions, the core team prioritized the pain points from the workshops using a 2×2 matrix, based on implementation difficulty and member impact. This framework surfaced the most critical problems to address in the member experience for each card.

In the second session, we evaluated how improvements to the member experience would impact the card-related efforts. We systematically assessed each effort against the set of pain points, simply asking, “Does this effort address the pain point?”

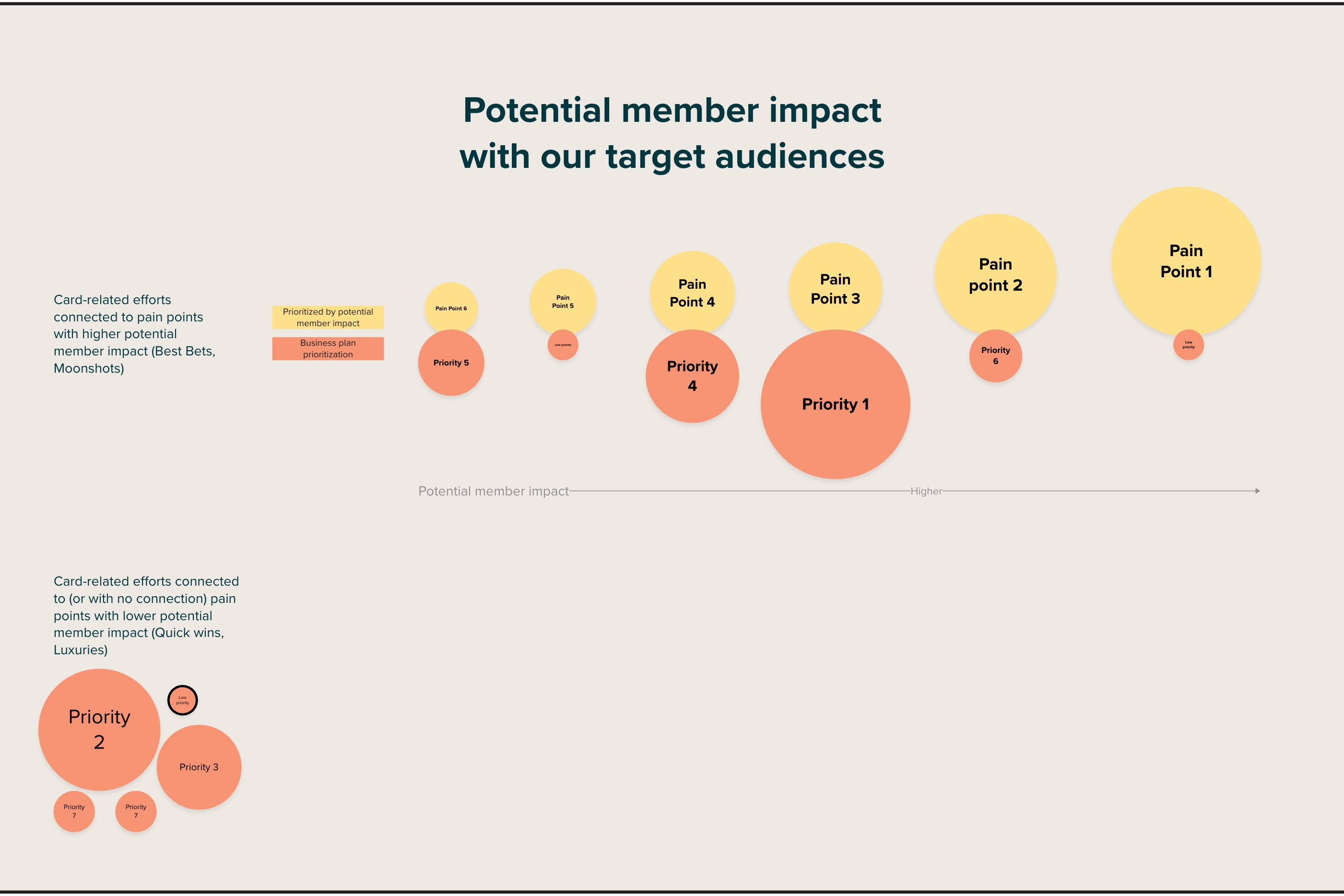

As insightful as these two sessions were, the most significant discovery occurred in the third session. Here, we juxtaposed our prioritized pain points with the existing card-related priorities in the business plan. This comparison revealed significant discrepancies between the opportunities to drive more member value and the efforts prioritized in the current business plan. It was an uncomfortable but eye-opening moment, and this informative insight would go on to influence the business plan for the following year.

Outcome

The insights and visual artifacts helped the line of business and supporting functions have more actionable discussions and plan their card-related work in service of shared, member-centered goals.

The insights also influenced organizational business planning, leading to a reprioritization of card-related efforts. One of the top priorities in the new plan was improving the digital portal to deliver a simplified credit card loan application experience for both members and staff.

In the last year, digital portal enhancements have resulted in shortened loan application and approval time, reduced phone calls for application support, and increased data accuracy across connected systems.

The work done is so helpful and meaningful to how we prioritize work.

- Vice President and functional stakeholder