Problem

In late 2021, the Consumer Financial Protection Bureau announced efforts to crack down on aggressive overdraft fees with an intent to set and enforce more stringent guidelines that protected the consumer.

The impending actions of the CFPB would have a direct impact on our overdraft services and an indirect impact to the unique benefits we offered our members. For our members – specifically those with limited options to affordably access cash – we needed to find a sustainable way to continue providing financial assistance while complying with new regulations and remaining profitable.

Approach

As project lead, I organized a cross-functional team, representing a diversity of perspectives, to tackle the complex problem. Our project plan featured human-centered, collaborative activities supported by design thinking mindsets and creativity. The focus to get participants to generate wild and innovative ideas was balanced with just enough pragmatic, analytical rigor to land on something that could be supported. Over the next few months, I guided our team through our design innovation framework to discover the problem, imagine and test a variety of strategic possibilities, and develop a future strategy around the one possibility that was the most logically compelling.

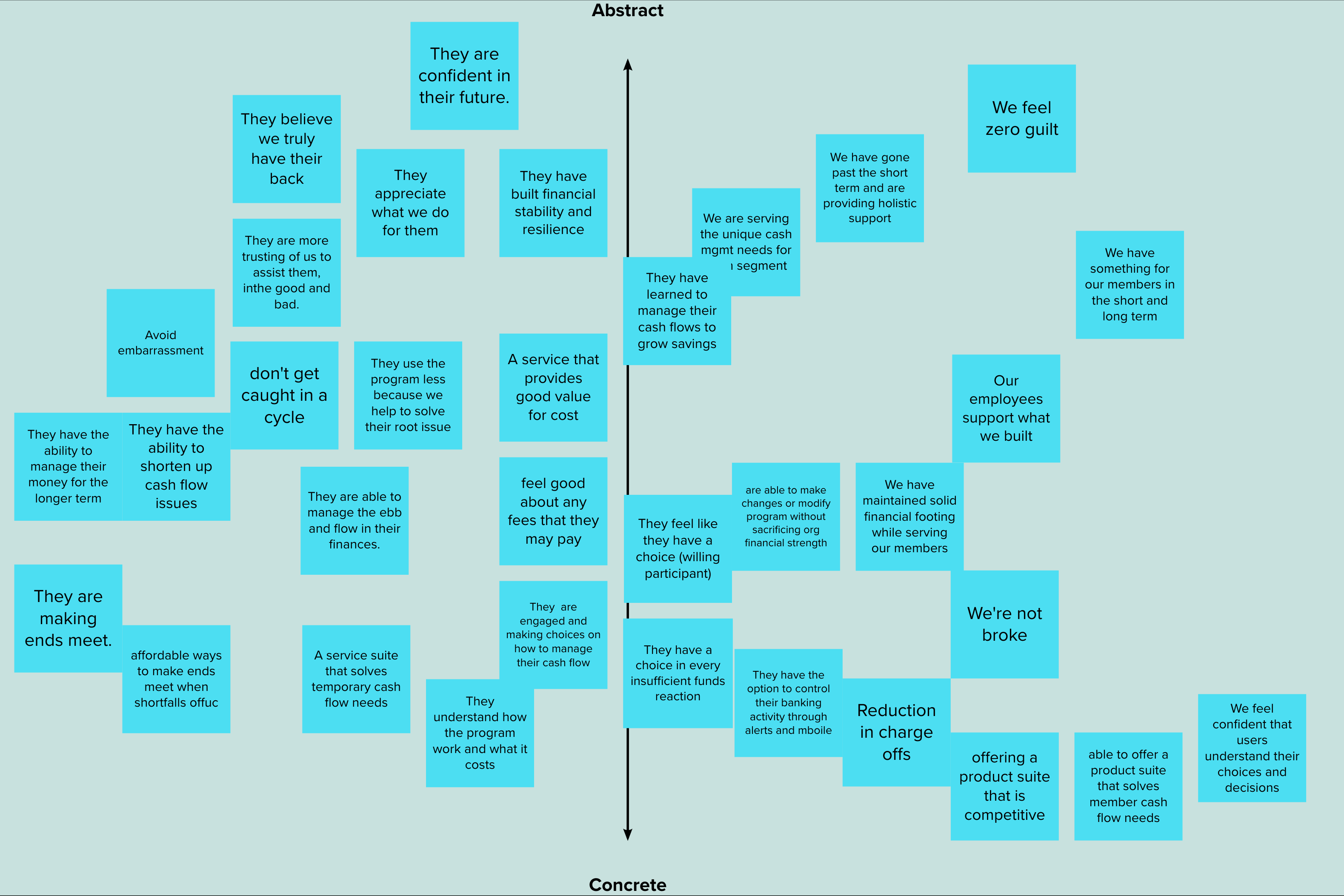

Discovery began with a problem framing workshop, facilitated with organizational stakeholders, to get a deeper understanding of the business problem. In the workshop, we surfaced concerns, assumptions, and learned about previous and upcoming efforts tied to improving our overdraft services. We spent time breaking down the current strategy before turning to the future and defining a winning aspiration. By the end of the workshop, we had a clear vision of the future we wanted to create for our members and the business.

Now with a clear understanding of the business side of the problem, our team planned to fill our remaining knowledge gaps with help from our staff and customers. 1:1 interviews helped us develop empathy and deepen our understanding around our customers’ behaviors, attitudes, experience, and how they really felt about the options that existed in the marketplace.

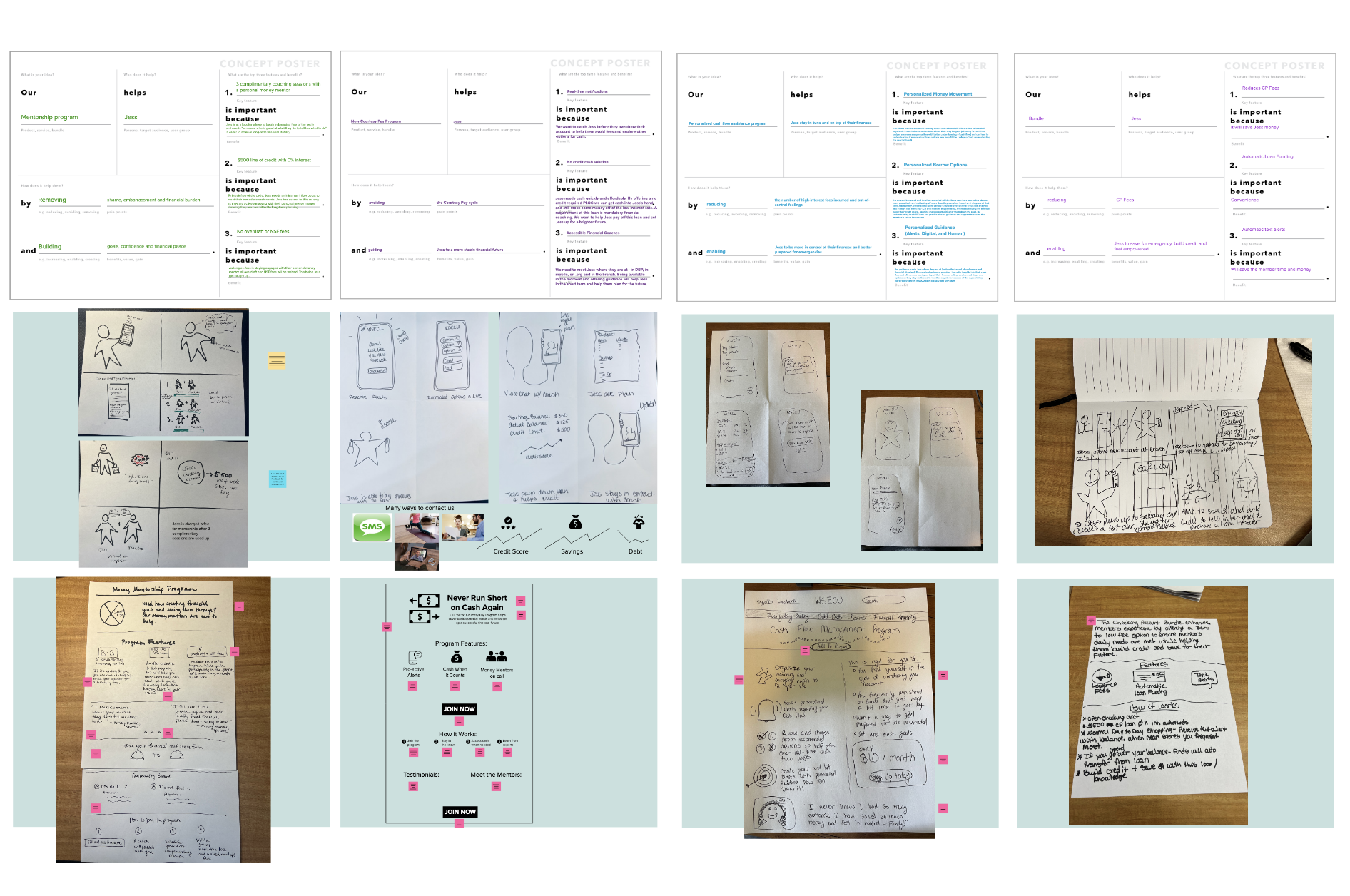

In the next phase of our strategy project, we used our research insights to inform design direction and creativity to encourage wild ideas. Design sprints turbocharged our efforts in designing, prototyping, and iterating on possibilities that imagined what a better, and more compliant, future could look like for our members and our business. Our design sprints guided us to a directional set of user feedback as well as rigorous, honest feedback from stakeholders analyzing each concept through their own business lens.

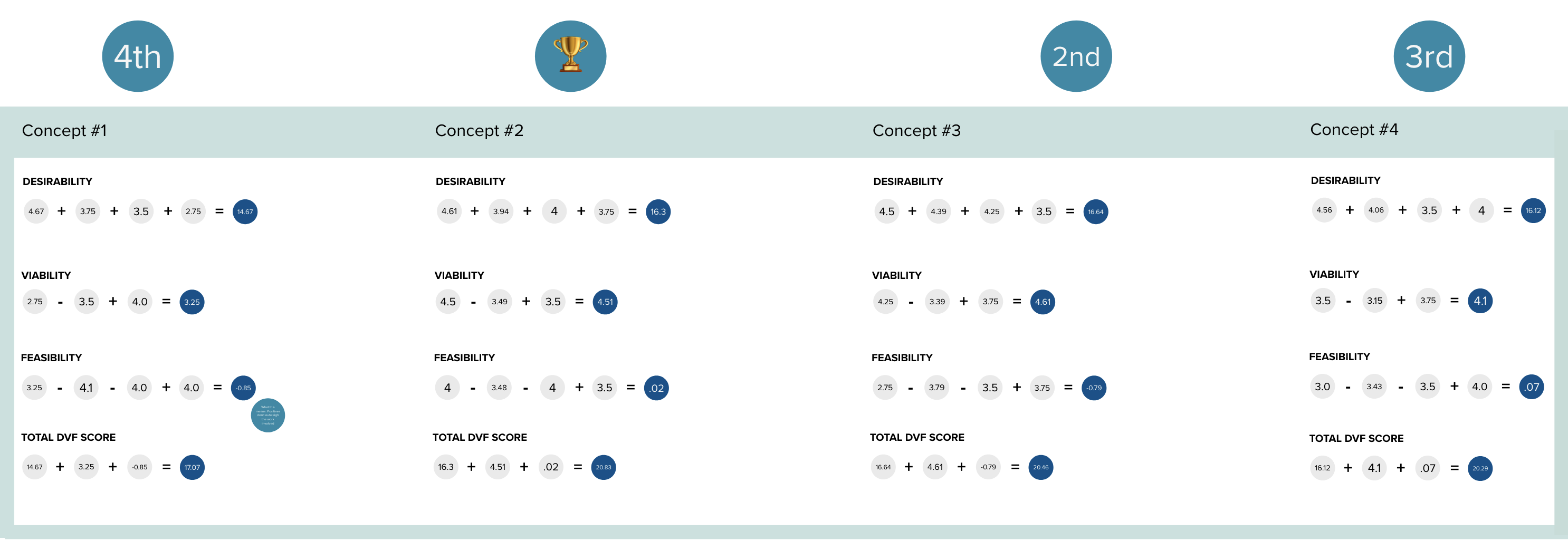

Next, we used scorecards to help us make a choice. Scorecards made it possible to consistently evaluate each possibility against the risks in desirability, viability, and feasibility. They also made it easier for our team to weight the qualitative feedback and insights and align on the most compelling strategic possibility.

To address outstanding, and newly discovered risks, we conducted two additional iteration cycles designing towards high-fidelity prototypes that tested favorably with real members.

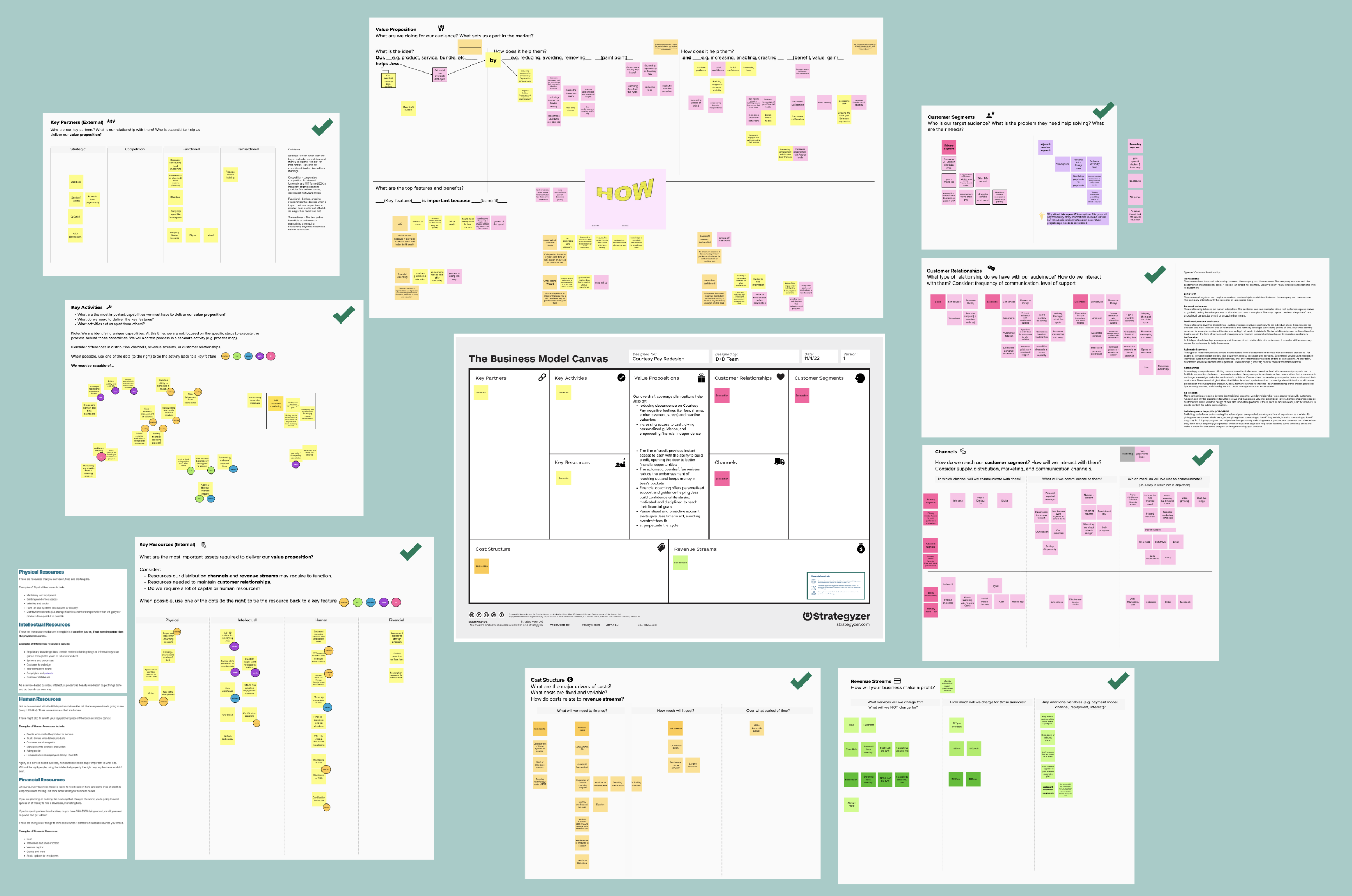

Our final step in the process was to articulate the strategy, and we did this with the help of a business model canvas. The canvas allowed us to visualize our strategy and have discussions with something tangible in hand.

Outcome

Our work concluded with a possibility that was validated as something customers would pay for and use immediately. The high-fidelity iteration of our strategic possibility reinforced the proof that members would pay for and use it in times where they needed cash fast. One member pressed, “It’s exactly what I need right now. When’s it slated to roll out?”

Unfortunately, key stakeholders found more near-term value in its parts. While, the solution incorporated existing capabilities, management systems, and was validated as technically feasible, it envisioned each at a scale that would require additional resources or reassignment of those already committed to in-flight initiatives.

However, breaking it apart proved valuable in solving the business problem. The insights generated from the prototypes provided a deeper understanding into what members needed and were willing to pay for and what we could feasibly deliver given our current resources. And stakeholders used these insights to update the prioritized initiatives in the business plan. The insights also influenced the addition of a new prioritized initiative – one that would explore a new type of checking account for members seeking immediate access to cash while meeting future regulatory compliance and improving the odds on near-term profitability for the business.

In this project, the proposed strategy was not approved. However, our work impacted organizational initiatives so that we could continue providing financial assistance to our customers in need of cash fast while adhering to new regulations and maintaining profitability.

I would absolutely use it. It's exactly what I need right now. When's it slated to roll out?

- Loyal customer of 19 years